How to outsource accounting services

02/12/2020

The above example indicates that company ABC is liquid enough to cover its current debts conveniently with the annual cash generation from operating activities. Applying formulas to specific line items of the financial statements enables calculations of the quantitative measures, also referred to as ratios. The cash coverage ratio is not a ratio typically run by a small business bookkeeper. If you’re a sole proprietor or a very small business with no debt on the books, other accounting ratios are much more useful, such as current ratio or quick ratio.

Formula and calculate the Cash Coverage Ratio

Most companies list cash and cash equivalents together on their balance sheet, but some companies list them separately. Cash equivalents are investments and other assets that can be converted into cash within 90 days. These assets are so close to cash that GAAP considers them an equivalent. Note that we also label the cash flow to debt ratio as the cash flow coverage ratio.

- Similarly, ABC Co.’s income statement included an interest expense of $25 million.

- Calculate the current cash debt coverage ratio by extracting the net cash flow from operating activities from the cash flow statement and dividing it by the company’s average liabilities.

- A higher ratio indicates that a company has enough cash resources to satisfy interest expenses.

- The cash portion of the calculation also includes cash equivalents such as marketable securities.

Ask Any Financial Question

The company has nearly twice as many short-term obligations despite having billions of dollars on hand. A high cash ratio may also suggest that a company is worried about future profitability and is accumulating a protective capital cushion. There may be extra non-cash things to deduct in the numerator of the calculation. For example, there might have been significant expenses in a period to enhance reserves for sales allowances, product returns, bad debts, or inventory obsolescence. This result means that the business in question can cover its interest expenses nearly 12 times over, leaving more than enough in cash to cover other obligations. The coverage ratio is also called the interest coverage ratio or the times interest earned (TIE) ratio.

Create a Free Account and Ask Any Financial Question

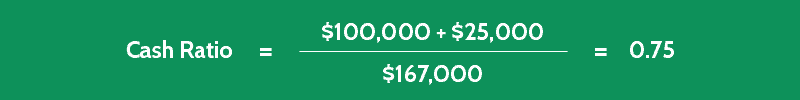

It calculates the ratio of a company’s total cash and cash equivalents to its current liabilities. This information is useful to creditors when they decide how much money, if any, they would be willing to loan to a company and for what tenor. Divide the total cash and cash equivalents by the total current obligations (including any interest expense). Include the company’s present obligations rather than its long-term liabilities.

What is Cash Flow Coverage Ratio?

Purposely, creditors leave out other sources of cash, such as accounts receivable and inventory. Clearly, the reason is that you can’t guarantee that you can convert these short-term assets to cash rapidly enough. what is product cost Thus, cash is available for creditors without the delay of selling off inventory or collecting receivables. Shareholders can also gauge the possibility of cash dividend payments using the cash flow coverage ratio.

Ideally, investors look for companies with a cash coverage ratio of two or higher. This suggests that the business can easily afford to pay off its current liabilities without borrowing money from outside sources or selling off its assets. However, some stakeholders focus on a company’s cash resources more than its total assets. While the asset coverage ratio may include cash, it also considers other resources. The 25.0% CFCR means the operating cash flow (OCF) of our company can cover a quarter of the total debt balance. Suppose we’re tasked with calculating the cash flow coverage ratio of a company to assess its current credit risk.

Equity finance is straightforward and comes from the company’s shareholders. As with any ratio, it’s important to view the results cautiously, understanding that an accounting ratio often represents just a single area of your business. However, they are a helpful tool and can provide you with insight into business liquidity, which is an important metric for anyone who owns a business. However, if you have current debt and interest expense, calculating this ratio can be important, particularly if you’re looking to assume more debt with a large purchase or business expansion.

Creditors like to utilize a cash coverage ratio since it reveals a company’s capacity to pay off debt promptly. Other formulas that take into account assets or inventories may not always provide an accurate projection of payment ability. Long-term assets or inventories may take longer to sell, making it harder to use the proceeds to settle obligations. Other ways for assessing a company’s financial health include the interest coverage ratio, debt service coverage ratio, and asset coverage ratio. The coverage ratio measures how easily a company can pay its debts with its current income. Lenders, investors, and creditors use the coverage ratio to gain insight into a company’s financial situation and determine its riskiness for future borrowing.